Get the free maryland form 515

Show details

See Form 502 Instructions. Who must file Decide if you must file a nonresident Maryland income tax return Form 515. S E C U R I T Y Cents 2002 MARYLAND FORM 515 PAGE 2 Amount from line 25 Maryland adjusted gross income. 50. 2. 3. Multiply line 2 by the Maryland income factor from line 30. Enter this amount here and on line 34 of Form 515. The wage income is taxed on Form 515 and the non-wage income on Form 505. you enter the total amount on line ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

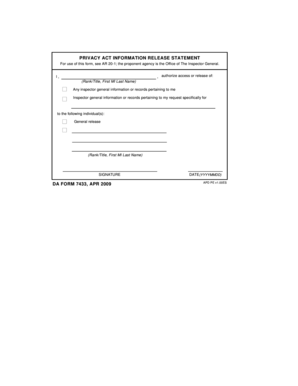

Edit your maryland form 515 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your maryland form 515 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing maryland form 515 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit maryland form 515. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

How to fill out maryland form 515

How to fill out maryland form 515:

01

Obtain a copy of the maryland form 515 from the appropriate source.

02

Read the instructions carefully to understand the purpose and requirements of the form.

03

Provide all the necessary information accurately in the designated fields of the form.

04

Double-check the form to ensure that all required sections have been completed.

05

Sign and date the form where indicated.

06

Attach any additional documentation that may be required according to the instructions.

07

Make copies of the completed form and any supporting documentation for your records.

Who needs maryland form 515:

01

Individuals or businesses who are required to report certain incomes or payments to the state of Maryland.

02

Non-residents who have earned income within the state of Maryland.

03

Employers or payers who have made payments to individuals or businesses in Maryland that need to be reported for tax purposes.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is maryland form 515?

Maryland Form 515 is a tax return form used to report nonresident income derived from sources within Maryland. It is filed by individuals or estates who are nonresidents of Maryland but earned income from Maryland sources. This form allows them to calculate and pay the appropriate amount of nonresident tax owed to the state of Maryland.

Who is required to file maryland form 515?

Individuals and businesses who have received income from sources in Maryland are required to file Maryland Form 515. This includes residents of Maryland, non-residents who have earned income from Maryland sources, and part-year residents who have earned income from Maryland sources during the portion of the year they were resident in the state.

How to fill out maryland form 515?

Form 515, also known as the Maryland Nonresident Income Tax Return, is used by individuals who are nonresidents of Maryland but have earned income from sources within the state. Here are the steps to fill out the form:

1. Download and print Form 515 from the official website of the Comptroller of Maryland.

2. Provide your personal information in Section A, including your name, Social Security number, and mailing address.

3. In Section B, provide your spouse's information if applicable.

4. Indicate the filing status you are choosing by checking the appropriate box in Section C.

5. In Section D, calculate your Maryland taxable income. Start by entering your federal adjusted gross income from your federal tax return. Then, make adjustments for any additions or subtractions specified on Form 515.

6. Complete Part 1 by providing details of your income earned from Maryland sources, such as wages, salaries, tips, and self-employment income. Include all applicable forms (W2, 1099, etc.) when submitting your return.

7. Calculate your taxable income in Part 2 by subtracting deductions, exemptions, and credits from your total Maryland income.

8. In Part 3, calculate your Maryland tax liability based on the tax rates provided in the instructions.

9. Complete Part 4 if you made estimated income tax payments throughout the year, and enter the amount paid.

10. Calculate any penalties or interest owed in Part 5 if you did not pay enough estimated tax or if you filed your return late. This section may not apply to everyone.

11. Complete Part 6 if you are claiming any tax credits, such as the Retirement Income Tax Credit or Child and Dependent Care Credit.

12. If you have any additional information to include or want to explain any changes you made, use Part 7.

13. Lastly, sign and date the form in Section E.

14. Make a copy of the completed form for your records and mail the original form along with any applicable attachments (W2, 1099, etc.) to the address provided in the instructions.

It is recommended to review the instructions provided with Form 515 to ensure accurate completion of the form. If you are unsure or have complex tax situations, consider consulting with a tax professional or using tax software to assist you.

What is the purpose of maryland form 515?

Maryland Form 515 is the form used by individuals or businesses to request a six-month extension for filing their Maryland income tax return. The purpose of this form is to provide taxpayers with additional time to gather the required documents and information to complete their tax return accurately. By submitting Form 515, taxpayers can avoid penalties for failing to file their tax return on time.

What information must be reported on maryland form 515?

Maryland Form 515, also known as the Maryland Sales and Use Tax Return, requires several pieces of information to be reported. Here is a list of the main information that must be included on Form 515:

1. Identification Information: This includes the taxpayer's name, address, and Social Security Number or Employer Identification Number.

2. Reporting Period: The specific reporting period for which the sales and use tax return is being filed. This typically corresponds to a specific month or quarter.

3. Gross Sales: The total gross sales made during the reporting period, including both taxable and exempt sales.

4. Taxable Sales: The total amount of taxable sales made during the reporting period. This includes sales subject to Maryland's sales tax.

5. Sales Tax Collected: The amount of sales tax collected from customers during the reporting period. This is calculated by applying the appropriate tax rate to the taxable sales.

6. Use Tax Due: If there were any purchases made that were subject to use tax, this amount must be reported separately. Use tax is generally paid when sales tax was not collected at the time of purchase.

7. Credits and Deductions: Any applicable credits or deductions should be reported on Form 515. This may include credits for taxes paid in other jurisdictions or deductions for specific exemptions.

8. Net Tax Due: Calculated by subtracting any credits or deductions from the total sales tax due.

9. Penalty and Interest: If the sales and use tax return is filed past the due date or if any late payments were made, penalty and interest charges may apply. These amounts should be calculated and reported accordingly.

10. Total Amount Due: The final amount of sales and use tax due, including any penalty and interest charges.

It is crucial to consult the instructions provided with Maryland Form 515 or seek professional advice to ensure accurate filing and reporting.

When is the deadline to file maryland form 515 in 2023?

The deadline to file Maryland Form 515 for tax year 2023 is April 15, 2024.

What is the penalty for the late filing of maryland form 515?

The penalty for late filing of Maryland Form 515 depends on the amount of tax due and the number of days late. The general penalty for late filing is 10% of the unpaid tax, with additional interest charges on the unpaid tax. The maximum penalty for late filing is 25% of the tax due. It is important to note that penalties and interest rates may vary, so it is advisable to consult the Maryland Comptroller's website or seek professional advice for the most accurate and up-to-date information.

How can I manage my maryland form 515 directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your maryland form 515 along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I send maryland form 515 for eSignature?

When you're ready to share your maryland form 515, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I fill out the maryland form 515 form on my smartphone?

Use the pdfFiller mobile app to fill out and sign maryland form 515. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Fill out your maryland form 515 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.